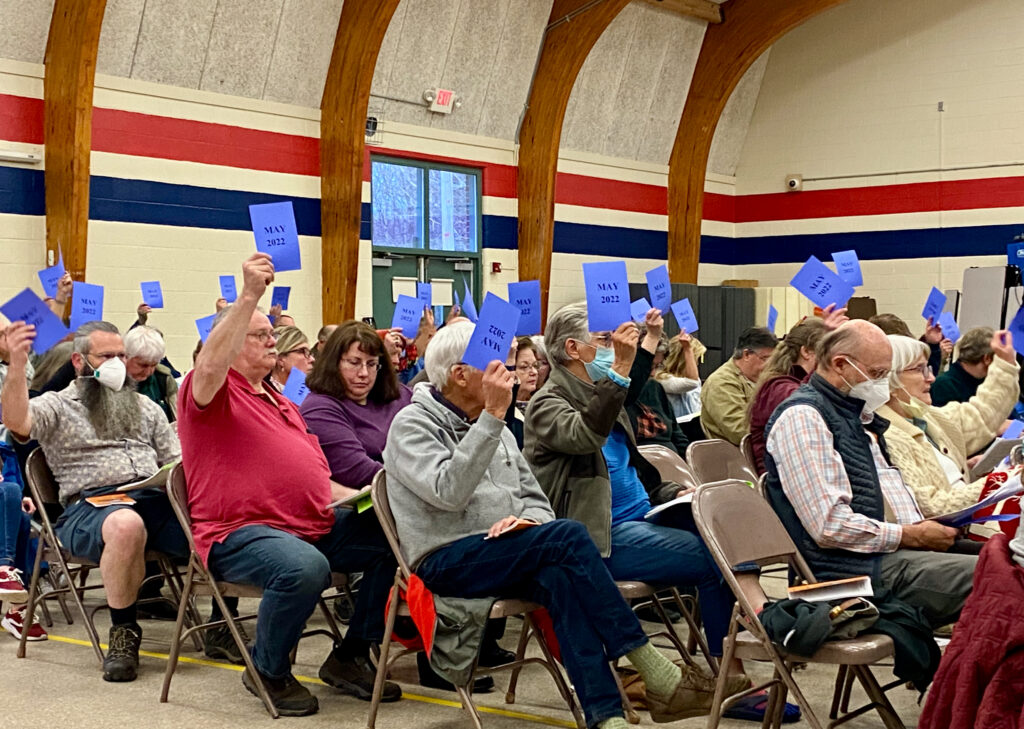

New Gloucester’s Annual Town Meeting convenes Monday, May 6, at 7 p.m. at Memorial School, 86 Intervale Road. Voters will consider proposed FY25 municipal operating budgets, capital projects, payments into capital reserve accounts, anticipated revenues, zoning ordinance changes and more.

Voter check-in begins at 6:30 p.m. Residents may register to vote at the meeting.

The 2024 annual town meeting booklet lays out, article by article, the 38 items voters will consider. Booklets will be available at the meeting as well as at Town Hall. (Please note that the Town Hall service window will close at 5 p.m. on May 6 so that staff can prepare for Town Meeting.)

Municipal budget. As of the March 7 budget public hearing, the Select Board’s proposed FY25 Town expenditures–that is, not including schools and the county–totaled some $7,221,339, an increase of about 7.5 percent over the current year’s $6,673,089 in spending.

Updated totals have not been shared since then, but the town meeting warrant reflects several later additions, including for repairs to Fire Rescue Engine 3, repairs to the Library roof and bell tower, and replacement of a waste oil furnace at the Public Works building. If approved, those items would be funded from the Undesignated Fund Balance, the Town’s surplus.

Other items in the proposed budget:

— $700,000 for paving/chip seal projects, with $200,000 for Morse Road coming from the TIF account; the Finance Committee recommended $605,000, one of their few points of divergence from the Select Board’s figures. In FY24 $478,000 was allocated for paving/chip seal.

— $340,000 for a dump truck with plow for Public Works;

— $225,000 toward a loader for Public Works;

— A total of $585,000 in deposits into various capital reserve accounts for later big-ticket vehicle and equipment purchases for Fire Rescue, Public Works and the Transfer Station, and for long-term projects at the Town Hall Complex and for Parks and Recreation;

— $175,000 to cover departmental overdrafts in the current year, with funds to come from the Undesignated Fund Balance;

— $75,000 toward permanent bathrooms and storage at the Fairgrounds;

— A three percent cost-of-living increase for all Town staff, with higher increases for others, including Fire Rescue per diems, to help recruitment and retention;

— A new full-time Town Office position with benefits;

— A new part-time position for the Library (28 hours per week, no benefits);

— $500,000 to be taken from the Undesignated Fund Balance to reduce tax impact.

Most of the budget articles reflect the amounts recommended by the Select Board and Finance Committee, respectively. Voters may adopt either number, something in between, or something lower but not higher. Netted out, the Finance Committee’s FY25 recommendations came in $140,538 lower than those of the board.

Zoning ordinance changes. Voters will also consider three sets of revisions to the Town’s zoning ordinance:

— amendments to comply with the requirements of LD 2003, the state housing law that provides for denser development and reduces restrictions against accessory dwelling units (ADUs) statewide.

In New Gloucester, the proposed changes would mainly affect ADUs (‘in-law apartments,’ converted garages, additions and the like), allowing them to be larger and in more locations, with no requirement of owner occupany or family relationships. Read more at this link.

— a new floodplain management ordinance. In order for residents to be eligible for flood insurance, the Town is required to have a flood management provisions in place. The proposed ordinance accomplishes that, using language provided by the state to meet federal requirements; and

— amendments that streamline the process for applicants who want to make minor changes to their already-approved site plan.

Find the proposed ordinance changes and explanatory information at this link. If approved at town meeting, the ordinance changes will proceed to a referendum ballot vote at the June 11 election.

The budget(s) and anticipated tax rate. Your property tax bill covers the Town’s budget, as approved at town meeting, New Gloucester’s share of the Cumberland County budget, and New Gloucester’s share of the MSAD 15 school budget. The GNG school budget will be considered by voters at a separate town budget meeting/validation later this month and a ballot referendum in June.

With the caveat that budgets and property valuation aren’t yet final, the May 6 town meeting booklet includes an estimated FY25 mil rate: $14.93 per thousand dollars of valuation, an increase of 64 cents from this year’s rate of $14.29. That would be the equivalent of an additional $224 on a home valued at $350,000.

But the actual tax rate will ultimately depend on what final budget numbers New Gloucester voters pass, starting with the municipal budget at town meeting. Join your neighbors at Memorial School on Monday, May 6, at 7 p.m. to add your voice.

— Joanne Cole

Editor’s note: The article has been updated to correct the amount of TIF funds to be used to pave or chip seal Morse Road. It should be $200,000, not $100,000.