At their August 15 meeting, the Select Board will set the mil rate for FY23 taxes, hear a presentation from summer intern Hung Nguyen on his analysis of town roads, and get an update from Town Planner Natalie Thomsen about preliminary research and possible grant support for Upper Village planning.

In addition, Chair Peter Bragdon says the board hopes to announce the appointment of an Interim Town Manager. An offer has gone out, Bragdon told NGX.

The meeting starts at 7 p.m. in the Meetinghouse and will be live-streamed on Town Hall Streams at this link and broadcast on local Cable, assuming new tech upgrades cooperate. Find the full meeting agenda and supporting documents at this link.

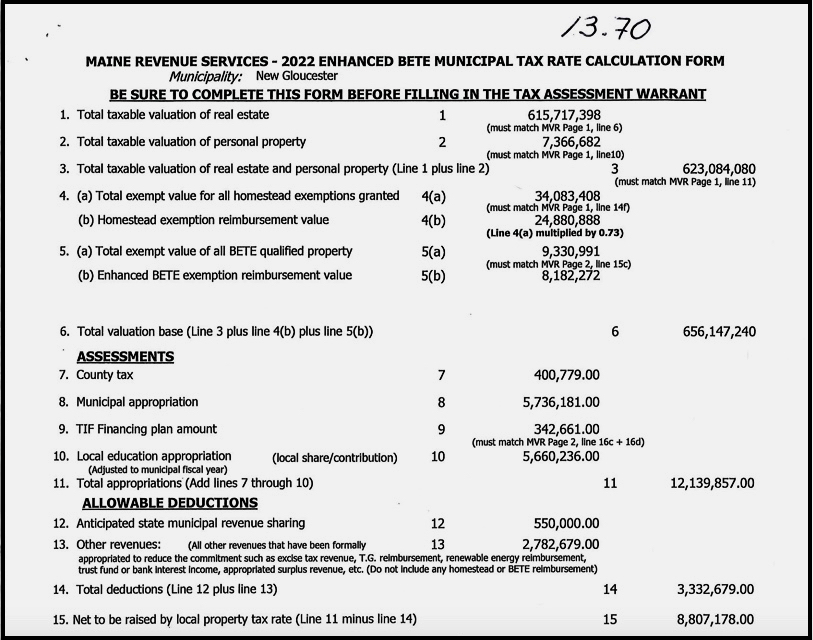

FY23 tax rate. The board will convene as Assessors to set the FY23 tax rate and overlay, likely with an assist from Mike O’Donnell of John E. O’Donnell & Associates, the town’s assessors’ agent. The current mil rate is $13.80 per thousand of valuation. The board appears to be considering rates of $13.70, $13.80 and $13.90 for the coming year to raise some $8.8 million (for schools, county and town budgets) from property taxes.

Maine law allows municipalities a tax buffer—the overlay—of up to an additional five percent to cover contingencies. The FY23 overlay amount will also be set at this meeting. Find helpful breakdowns of the different tax rate scenarios at pp. 4-7 of the agenda packet. Tax bills for FY23 will go out later this month, with payments due October 6 and April 6.

Among other items, the board on Monday is expected to

— discuss scheduling a public meeting regarding ARPA spending and priorities for the Select Board and the Comprehensive Plan (p. 64);

— consider who might serve on a task force for the town’s new M-DASH initiative (pp.50-51);

— discuss whether to add seats to several committees now that their Select Board liaisons are non-voting (p.65)

— address disposition of a foreclosed property at 1173 Lewiston Road (Map 10 Lot 63-C). The land and building are assessed at $89,000 (pp.58-63); and

— award contracts for heat pumps for the Meetinghouse and Library; seasonal sand, gravel and rip-rap; and a new phone system (pp. 31-49).

Find department reports for July in the packet as well, at pp. 11-30.

To submit a written public comment for this meeting, send an email by 10 a.m. Monday August 15 to both the Town Manager (townmanager@newgloucester.com) and Deputy Clerk (smyers@newgloucester.com). Include your name and address, and if you want your comment read aloud, include “please read.” Staff ask that comments be submitted in Word or PDF format. Find details at the Municipal Officers page here.